Collecting Vendor Information - W-9

From AYSO Wiki

Before making a payment to a vendor it is important to collect tax information. All vendors with payments greater than $600 in the fiscal year might need a 1099.

It is important to validated the information provided by vendors. See Validating Vendor Tax ID for next steps.

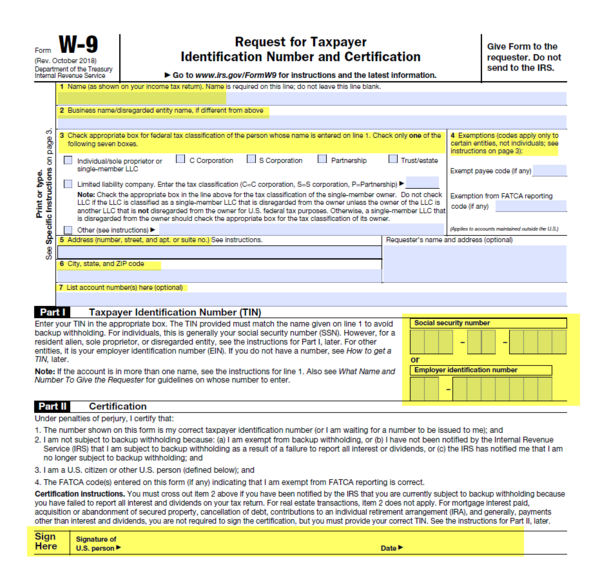

- W-9 is a tax form used by the IRS to confirm a person/company's information.

- Complete form W-9: Request for Taxpayer Identification Number for each vendor submitted. E-mail this form to the AYSO Office Finance Department at finance@ayso.org. The AYSO Office cannot issue a 1099 to a vendor without this W-9. Also see Validating Vendor Tax ID for next steps.

- Any/all worksheets and W9’s must be received by the AYSO National Finance Department no later than January 10th of each year.

- Region should save all W-9’s in their one-drive folder labeled, W-9